does wyoming have taxes

If your business is responsible for collecting and remitting Wyoming sales tax you need to. Any sales tax collected from customers belongs to the state of Wyoming not you.

The Most And Least Tax Friendly Us States

What Taxes Do Businesses Pay In Wyoming.

. Wyoming has no state income tax. In the United States state sales taxes are only 4 percent. Where taxes are owed based on a businesses revenue.

C corporations are required to pay revenue taxes unlike S corporations. An example of taxed services would be one which sells repairs alters or improves tangible physical property. Nor does it have a gross receipts tax on businesses.

The average total sales tax rate is 539 counting both state and local taxes. Wyoming does not have its own income tax which means the state will not tax any form of retirement income. In Laramie County the average tax rate is a bit higher at 065.

Wyomings average effective property tax rate is also on the low side ranking as the 10th-lowest in the country. This includes Social Security retirement benefits. Similar to the personal income tax businesses must file a yearly tax.

The state also doesnt tax withdrawals from retirement accounts like 401 k plans. Wyoming has no state income tax. However the state has laws concerning intestate succession probate taxes what makes a will valid and more.

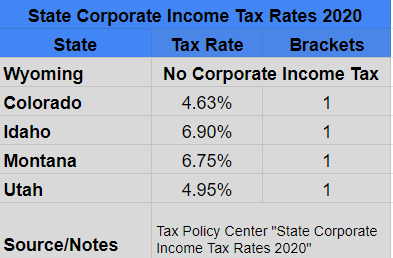

Does Wyoming have business tax. The Wyoming corporate income tax is the business equivalent of the Wyoming personal income tax and is based on a bracketed tax system. Wyoming also has low property taxes with an average effective rate of just 057.

The overall property taxes in Wyoming have an average rate of. Wyoming Sales Tax. 425 1 votes.

On top of this revenue tax owners and. Personal rates which generally vary depending on the amount of income can range from 0 for small amounts of taxable income to around 9 or more in some states. Wyoming workers will still pay FICA taxes and federal income taxes.

As just mentioned Wyoming is one of just a few states that have neither a corporate income tax nor a personal income tax. Many states charge owners a tax. See the publications section for more information.

Wyoming is one of seven states that do not collect a personal income tax. However revenue lost to Wyoming by not having a personal income tax may be made up through other state-level taxes such as the Wyoming sales tax and the Wyoming property tax. It is normal for the tax rate to be above 6 percent even if additional taxes have been added in different counties or municipalities.

In fact at just 061 it has the eighth lowest average effective property tax in the country. Corporations are not subject to entity taxes. When you fill up your car with gas or buy a bag of groceries in Wyoming you will not pay any state tax on your gas or food.

The state does not have a corporate income tax. Sales and use tax in Wyoming is administered by the Wyoming Department of Revenue DOR. The sales tax in Wyoming is also low.

Taxes in Wyoming Each states tax code is a multifaceted system with many moving parts and Wyoming is no exception. States with no income tax often make up the lost revenue with other taxes or reduced services. Additionally counties may charge up to an additional 2 sales tax.

Wyoming actually doesnt have an income tax at all so any money you make in retirement including wages from a post-retirement job wont be taxed by the state. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming do not levy state income taxes while New Hampshire doesnt tax earned wages. Does Wyoming have sales and use tax.

Currently six states Nevada Ohio South Dakota Texas Washington and Wyoming do not. Wyoming state taxes minerals at 100 percent of the fair market value. What is the average cost of living in Wyoming.

NO TAX ON MINERAL OWNERSHIP. Heres another tax benefit of living in Wyoming. Wyomings corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Wyoming.

Sales tax 101 Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. The license tax is a tax on a businesss assets in Wyoming and applies to. C Corporations Versus S Corporations.

That means a home assessed at 250000 in that county would pay just 1615 a year. That has neither a corporate income tax. The taxes that you do pay here are based on the assessed value of the property.

Overview Of Wyoming Taxes. The state of Wyoming charges a 4 sales tax. While the general tax laws for Wyoming prevent double taxation this is not always the case for C corporations.

Wyoming does not have a state inheritance tax or estate tax. Wyoming sets itself apart in this area of taxation. Because it is one of only two states in the country.

Wyoming is a tax-friendly state. Property Tax is assessed at 115 for industrial property and assessed at 95. There are no taxes on your personal income.

Wyoming has among the lowest property taxes in the US. Corporate rates which most often are flat regardless of the amount of income generally range from roughly 4 to 10. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

The first step towards understanding Wyoming s. Only the Federal Income Tax applies. However Wyoming does have a property tax.

The biggest property tax burden falls on minerals. State wide sales tax is 4. If the holding company owns property in Wyoming the company should expect to pay property taxes at the following rates.

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. Wyoming is also one of the 9 states that dont have an income tax. Wyoming has very low property taxes compared to other states.

Compare this to Travis County in Texas. Property taxes and sales taxes in Wyoming are also among the lowest in the country. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

Wyoming residents do not have to pay any state income taxes which means more of your salary ends up in your pocket.

9 States Without An Income Tax Income Tax Income Sales Tax

Wyoming Income Tax Calculator Smartasset

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

The States With The Highest Corporate Income Tax Collections Per Capita Are New Hampshire Massachusetts California Alaska An Income Tax Business Tax Income

Aisha Balogun From Nigeria Graduated From The University Of Wyoming With A Major In Computer Engineering And Minor Video In 2021 Wyoming Wyoming Travel Road Trips Blockchain

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

These Are The Best And Worst States For Taxes In 2019

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations

States With Highest And Lowest Sales Tax Rates

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Wyoming Income Tax Calculator Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Tax Benefits Of Buying A Home In Jackson Hole Wyoming Wyoming Home Buying Inheritance Tax

Wyoming Wy State Income Tax Information

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

7 States Without Income Tax Mintlife Blog

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States